How to do the tax declaration in Poland | Easy guide for expats

Index

Are you an expat working as an employee in Poland and you wonder how and when to do your tax declaration? This is an easy guide for expats employed in Poland to pay their taxes.

Taxes in Poland: when to pay them

If you are residing in Poland, you can do your tax declaration between the 15th February and the 30th April of the year following the fiscal year.

It is good idea to do your tax declaration as soon as possible if you expect to receive some tax refund. The tax refund can arrive even just after one week after your tax declaration.

Taxes in Poland: how much

As a very short overview the tax rates in Poland for people are 17% until 85.528 PLN per year less some reductions, and after that amount they are 32%.

If you are an employee there are also some other fees that are deducted directly from your salary:

-

the contributions to the Social Insurance Institution, it is called ZUS (ZAKŁAD UBEZPIECZEŃ SPOŁECZNYCH) in Polish

-

the contributions to the National Health Fund, it is called NFZ (Narodowy Fundusz Zdrowia) in Polish, it is the institution responsible for public medical services in Poland.

Therefore, on what is left of your salary after ZUS and NFZ then the tax rates will be applied.

This website helps to calculate your net income from your gross income and viceversa: https://calculla.com/polish_net_gross_earnings_calculator

Please note that this paragraph is not an exhaustive guide about the Polish tax system, the purpose is to give a basic overview of the tax paid by people employeed in Poland.

Tax declaration in Poland: practical guide with images

By using the links suggested in this paragraph you can do your tax declaration online, without the need an accountant, maybe you need some help by google translate or somebody speaking polish.

First your employer needs to prepare a document called PIT 11, which contains all the details regarding your salary payments for the previous fiscal year. The PIT 11 usually is ready by the first half of February.

The steps below assume that you are getting an income in Poland, as an employee, that you have already a PESEL number (the polish fiscal identification number) and a bank account in Poland.

Here I suggest you two links to do your tax declaration:

-

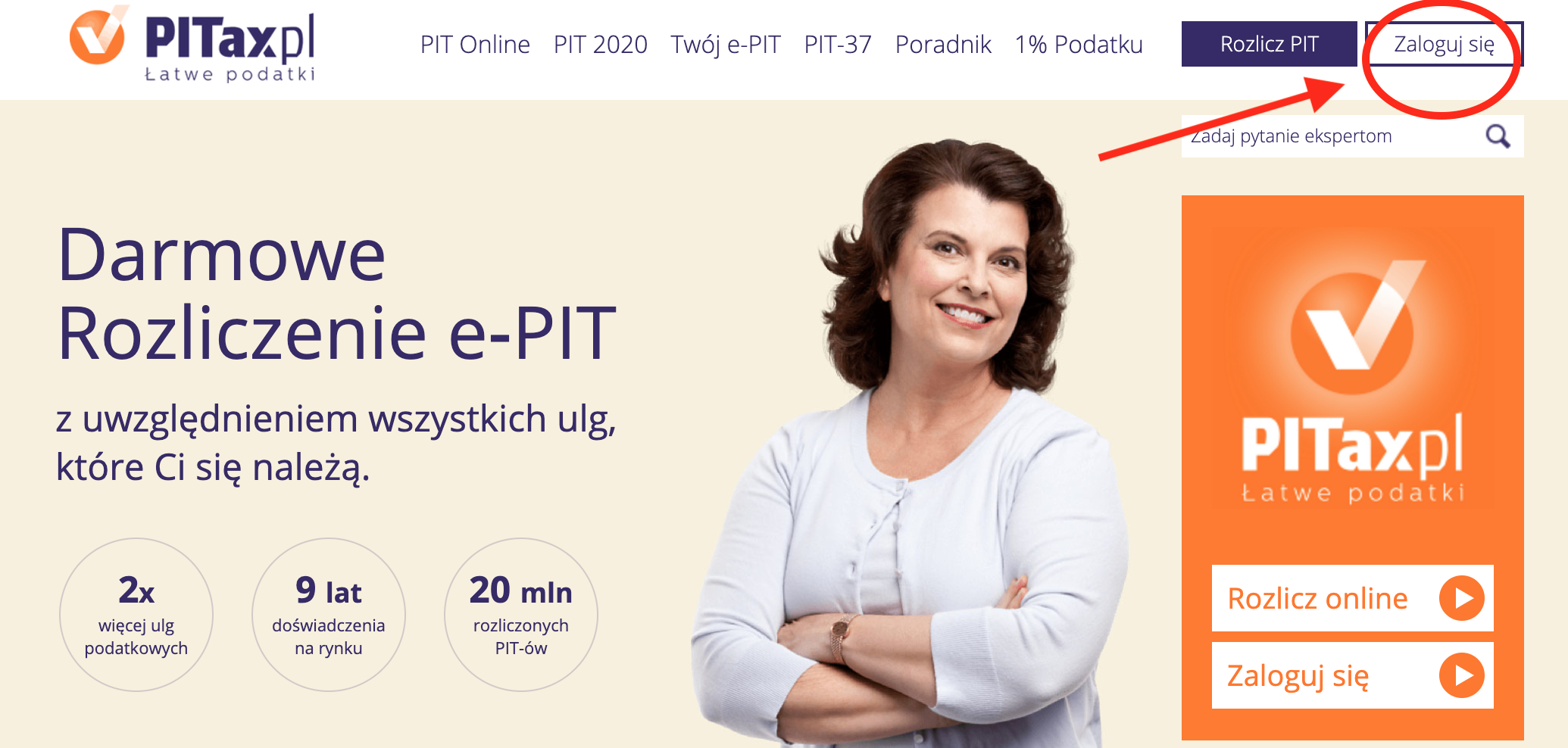

Register at https://www.pitax.pl/ and insert the details from your PIT 11 document. These are the steps to do it:

-

click on “Zaloguj się”

If you are not registered yet click on “Utwórz Konto”

If you are not registered yet click on “Utwórz Konto”  and fill the fields below. Otherwise click on “Zaloguj się”

and fill the fields below. Otherwise click on “Zaloguj się”  and fill the fields below

and fill the fields below -

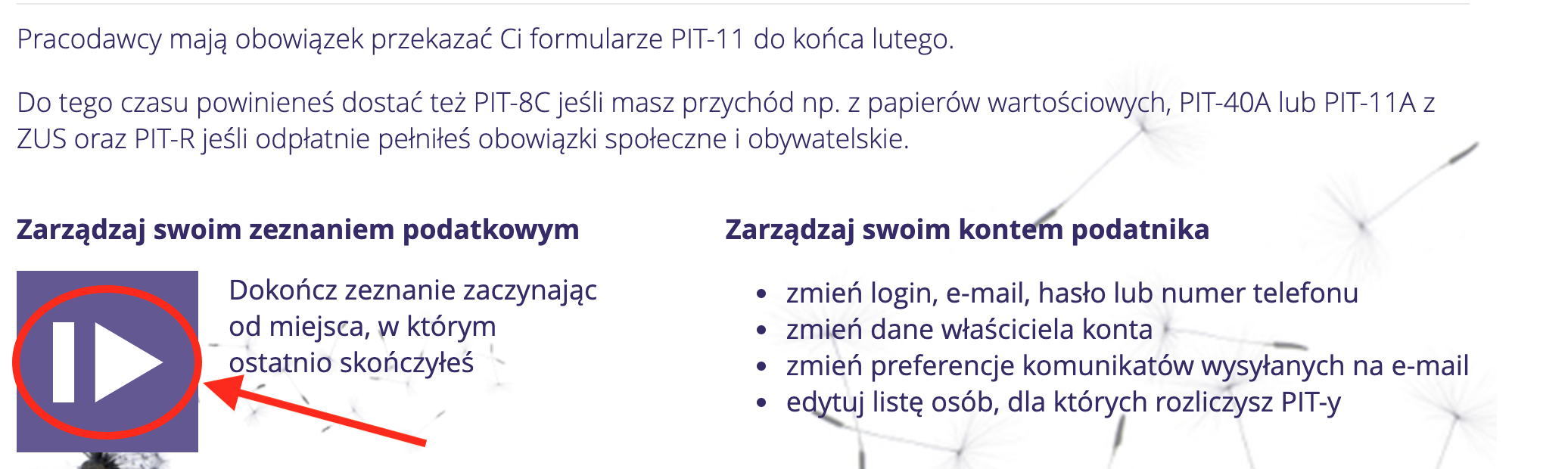

Click on the box on the left

-

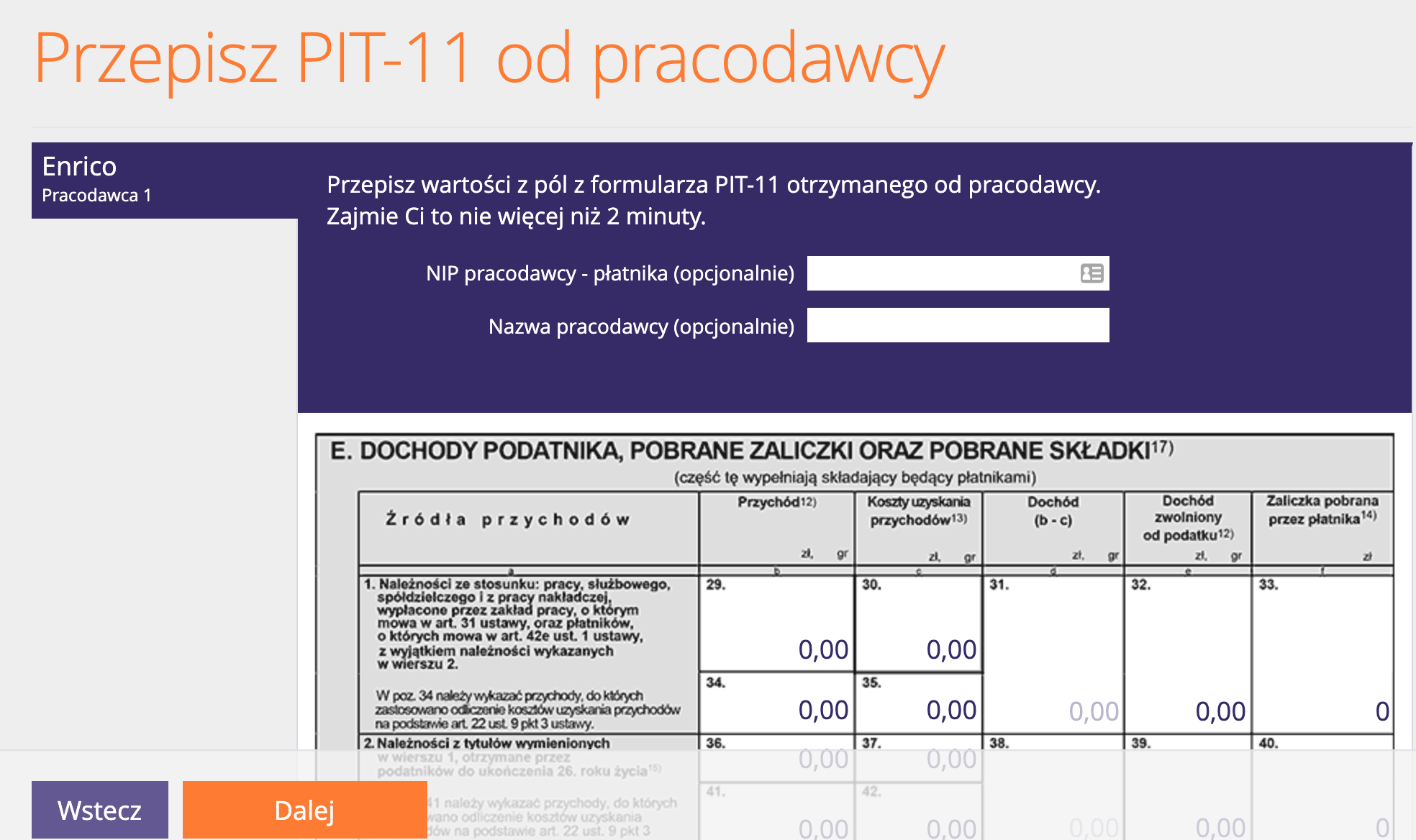

Copy in the fields the same values that you can find on your PIT 11 document

-

in the next steps you will be asked a set of questions about other sources of income and some deductions that can be applied. At these steps you can use google translator or ask to a polish speaking person to help you with the meaning.

-

At the end you get a document called PIT 37, which is your tax declaration report for the year.

-

-

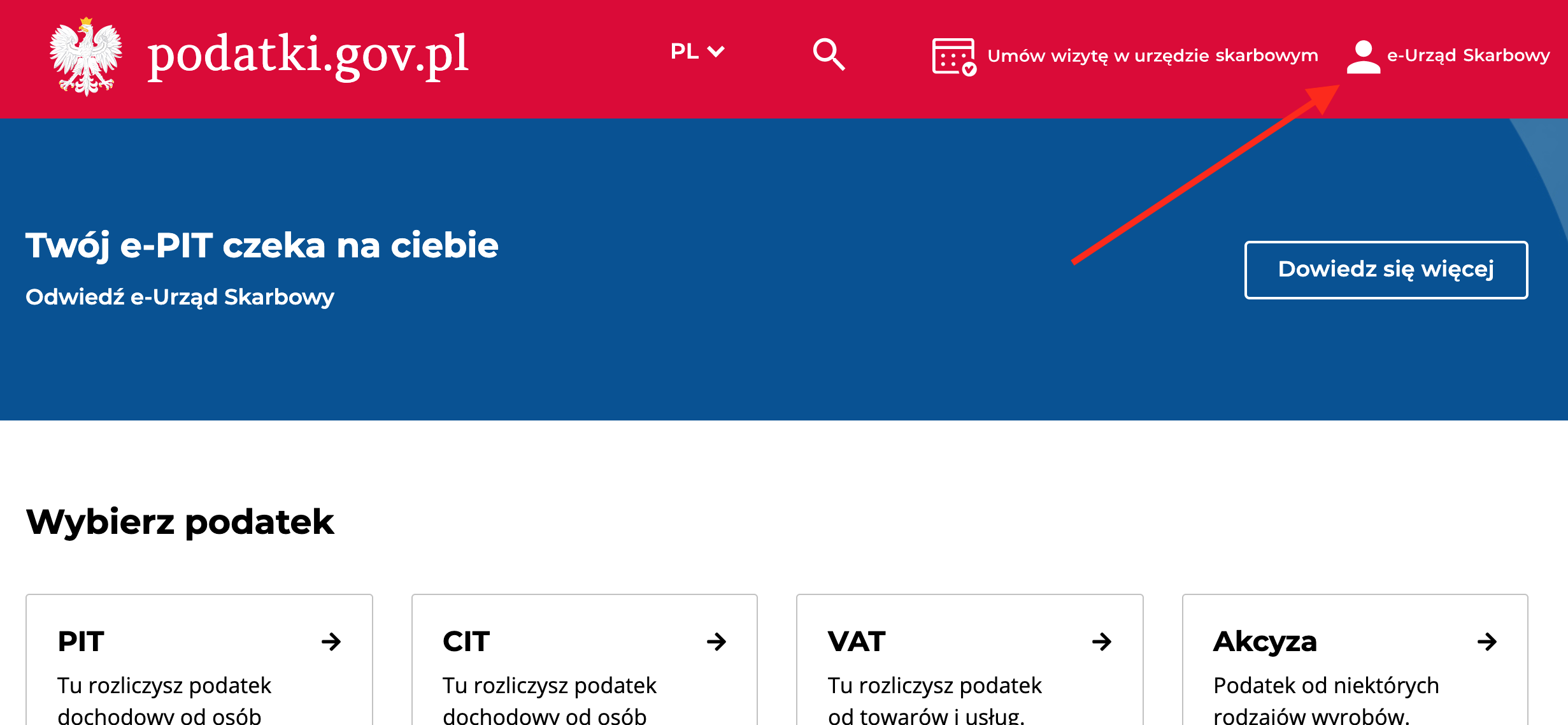

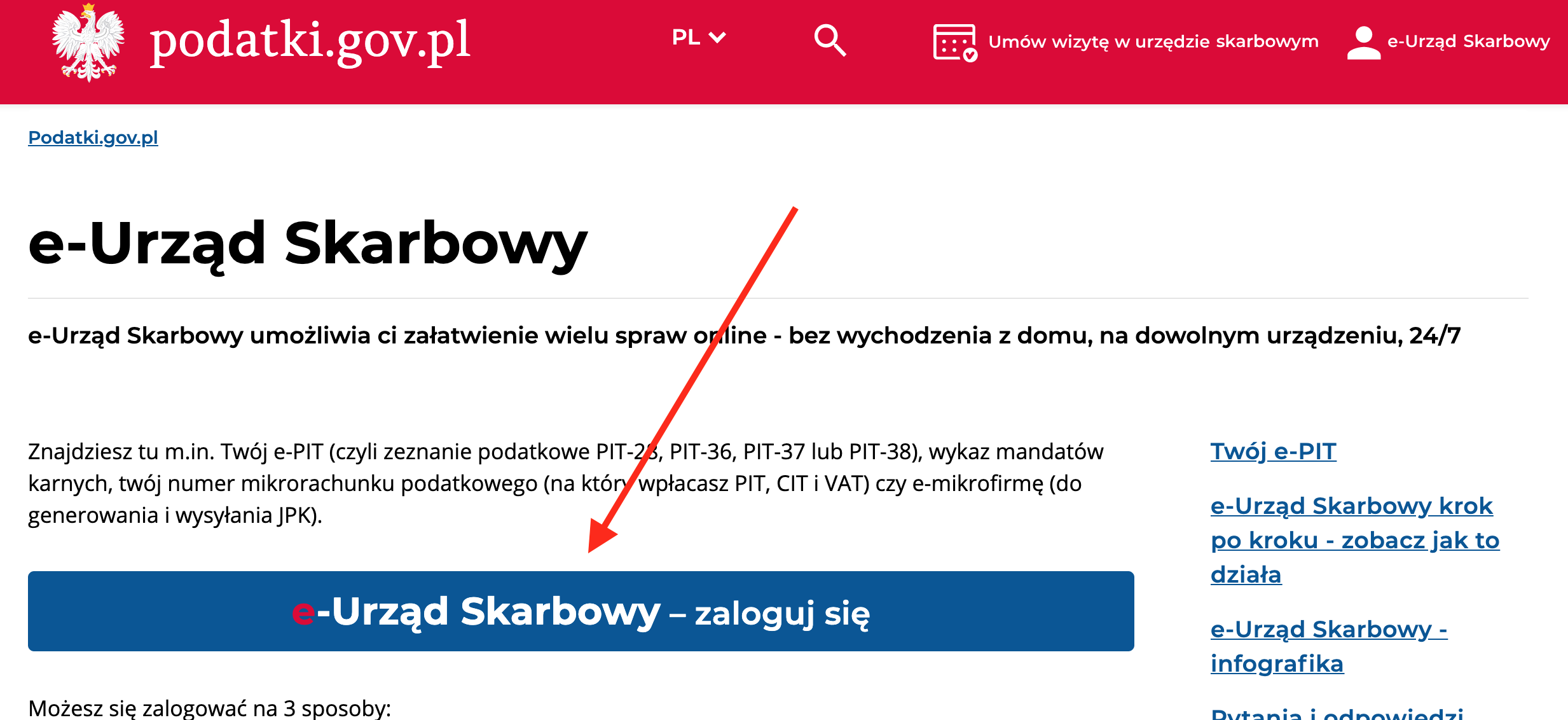

Register at https://www.podatki.gov.pl This is the ufficial tax office website.

Here the registration is a bit more complicated, but I suggest this method, because once you login you will find the data from your PIT 11 directly sent by your employeer. You just need to confirm the data that they already have.

Apparently this website has an English version, but the login it is possible only from the Polish version.

These are the steps to follow:

-

click on “e_Urząd Skarbowy”

-

then you can create an account where you can login using your bank account system.

-

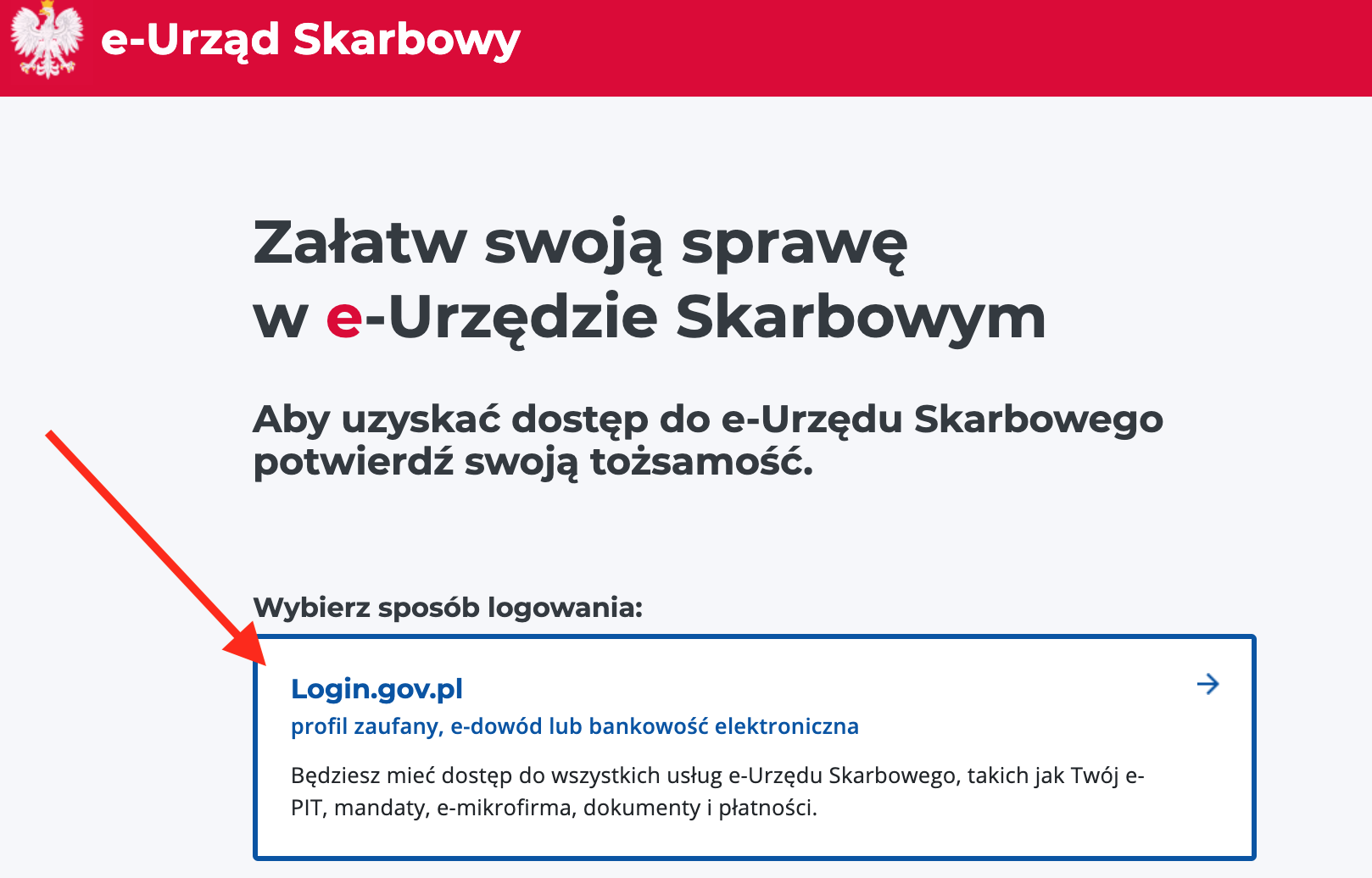

click at the box in the centre

-

click on Login.gov.pl

-

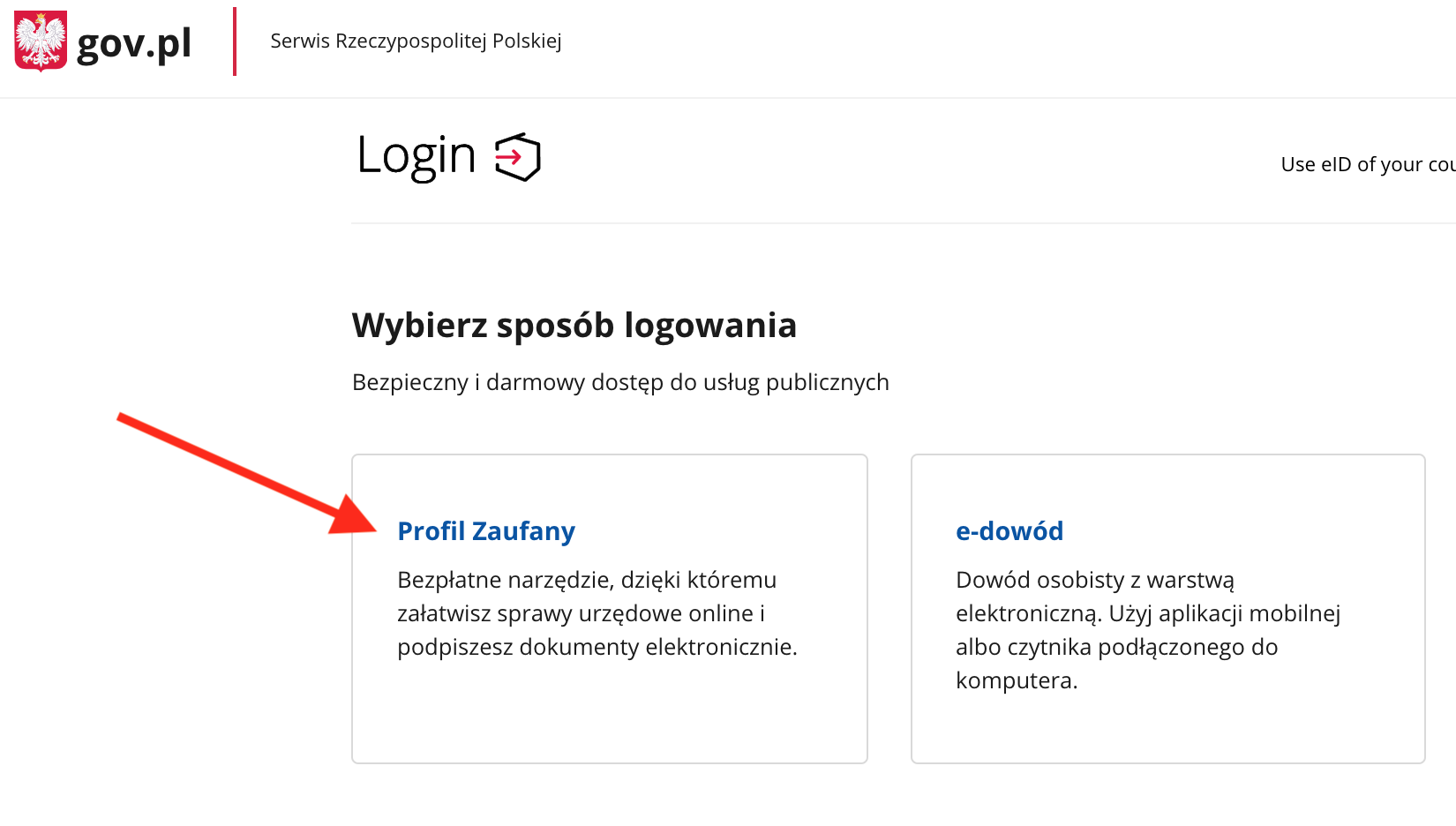

click on “Profil Zaufany”

-

here you can login with your bank credentials, provided you already created the login to the tax office with your bank account credentials.

-

once inside you will find your PIT 11 already filled and you just need to confirm the data. In case you have any tax credit you will be asked to insert the IBAN of your polish bank account.

-

As with the other link, at the end you get a document called PIT 37.